Everything in life (and business) has trade-offs. There are pros and cons to any choice, and the decision to deliver your customer feedback programme in-house is no exception. While on first glance in-house research might seem a cost-effective option, conducting your own feedback programme could introduce bias and reduce trust in the results. Both of which could end up costing you more in the long run.

In this article, we weigh up the perceived cost savings of in-house research versus the benefits that a professional research programme can provide.

The unseen costs of in-house research

Many companies perceive in-house research to be more cost effective, using ‘downtime’ from existing staff to make calls as a efficiency saving on outsourcing the research. However, to do a fair cost-benefit analysis, you need to consider how you would deliver not just the calls, but every stage of the research process.

Effective preparation

Data privacy, reliable sampling, survey fatigue, survey length, response codes, question wording…. These are all important factors that are carefully considered and built into a robust customer insight programme. The questions to ask yourself if considering delivering this in-house, are 1) do you have the experience in-house to carry out this preparation work? And 2) how long will this preparation take in staff time and resource?

A key part of your customer insight programme may be benchmarking with your peers, but it’s not always possible if you’re using different questions or response codes. Also, if your benchmarking peers use an independent professional research agency, they may question the validity of in-house data. Benchmarking is most reliable, and therefore useful, when you’re comparing apples with apples in a credible way that your stakeholders and benchmarking group can trust. So, if benchmarking is important to your organision, make sure you consider how you’ll do this reliably and effectively.

Collecting data efficiently

In this digital world, customer satisfaction surveys take place quickly over multiple channels. Customers want and expect that service providers worthy of their time will reach out to them using these same channels. If you’re considering taking your research in-house, you’ll need to consider:

- The cost of setting up a feedback collection process that incorporates telephone, SMS and online feedback

- The cost of managing a platform able to combine the data from each channel.

- How you’ll avoid duplication and prevent survey fatigue.

Digital platforms can save you money, but only if you can deploy them and manage them effectively.

Analysing data for insights

Mining spreadsheets to find that one gem which will make a real difference to how you do business can be a full-time job. If you have a large organisation it may take an entire team of data analysts. Ideally, you will have tools that slice through noisy data to pick up and track KPI movement, monitor trends, and flag critical service and safeguarding issues. But developing these business tools, keeping them up to date, and generating actionable insights is a detailed, time consuming and often expensive task. If you’re currently collecting research in-house, consider whether outsourcing could free up your teams’ time, which would be better spent analysing data or recontacting customers identified as in need of service recovery.

Reporting for influence and impact

In a post-Grenfell world, customer feedback has a new gravitas. Harnessing this in the right way to impact change is critical. Effective customer insight programmes worth their weight will present facts, enable insight, highlight issues and support workable solutions. Presenting actionable insights to your executive team, board, and other stakeholders is essential. Making these results easy to digest and communicate is an art – and it can be expensive to find and train an in-house resource with these skills.

In-house research can disrupt important feedback loops

When carrying out essential research, staff often take a customer-centric view, trying to resolve the issue for the customer during the survey. This is commendable, but doesn’t make for great research! Their knowledge of processes, systems and personnel can put them in the awkward situation of assisting the respondent instead of painstakingly recording every score and verbatim comment. So while this ‘helpful’ behaviour might be welcomed by your customer, it will not only invalidate your results, but also prevent you from understanding the pain points your customers are experiencing.

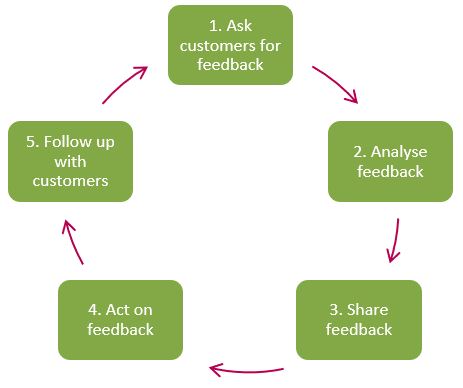

This type of double work is twice as inefficient because the customer satisfaction feedback loop is broken. In the customer feedback loop model below, if a customer’s negative feedback is resolved immediately (in step 1) and not recorded properly, that data cannot be analysed, shared or acted upon. This disrupts your organisation from learning (and fixing) the root causes of dissatisfaction.

Independence and impartiality matters

Gathering customer feedback independent of your own organisation guarantees that ratings and comments about your service are not processed by someone with an interest in your organisation’s performance. This impartiality assures your customers and stakeholders that performance results are accurate and stand up to scrutiny. Publishing and widely sharing results that your customers can trust is also a key theme of the Social Housing Green Paper. Your scores may initially decrease when changing over to an agency, but they will be an accurate picture of your satisfaction (which is surely, the reason for your research in the first place).

Ensuring insights are actionable

Data is one thing, but the insight that’s extracted from it is where the real magic happens. Most independent research agenices will offer value-added services, such as time series, data field filters, and sentiment analysis; as well as more advanced features such as key driver analysis, benchmarking and email alerts. Analysing your data into filtered fields such as neighbourhoods, repairs operatives or contractors, for example, can help you remedy issues quickly, resulting in improved satisfaction. It may be possible for you to develop your inhouse systems to include some of these options, but it’s important to consider what features you need to gather actionable insight before implementing your chosen system.

Engage and empower staff

Lastly, if you want to engage and empower your staff to effect change, then they’ll need access to feedback. Most agencies will present feedback centrally in an easy-to-use, secure web portal, where staff can access customer feedback, with privacy settings reflective of their role and data needs. If you decide to collect feedback in-house, it’s important to consider how you’ll keep staff engaged and informed, and how you’ll manage access effectively and securely.

In conclusion, while taking a feedback programme in-house can seem attractive on first glance, it’s important to weigh up all the unseen costs. You might save money initially with an in-house programme, but it is likely to impact on the effectiveness and efficiency of your research programme longer term. You might also miss out on some important key benefits you’d lose from working with an independent provider. So, before you decide to take your programme in-house to protect your budget, make sure you weigh up all the pros and cons to make an informed choice.

Want to learn more? Get in touch

For more information about commissioning a research project, please get in touch.